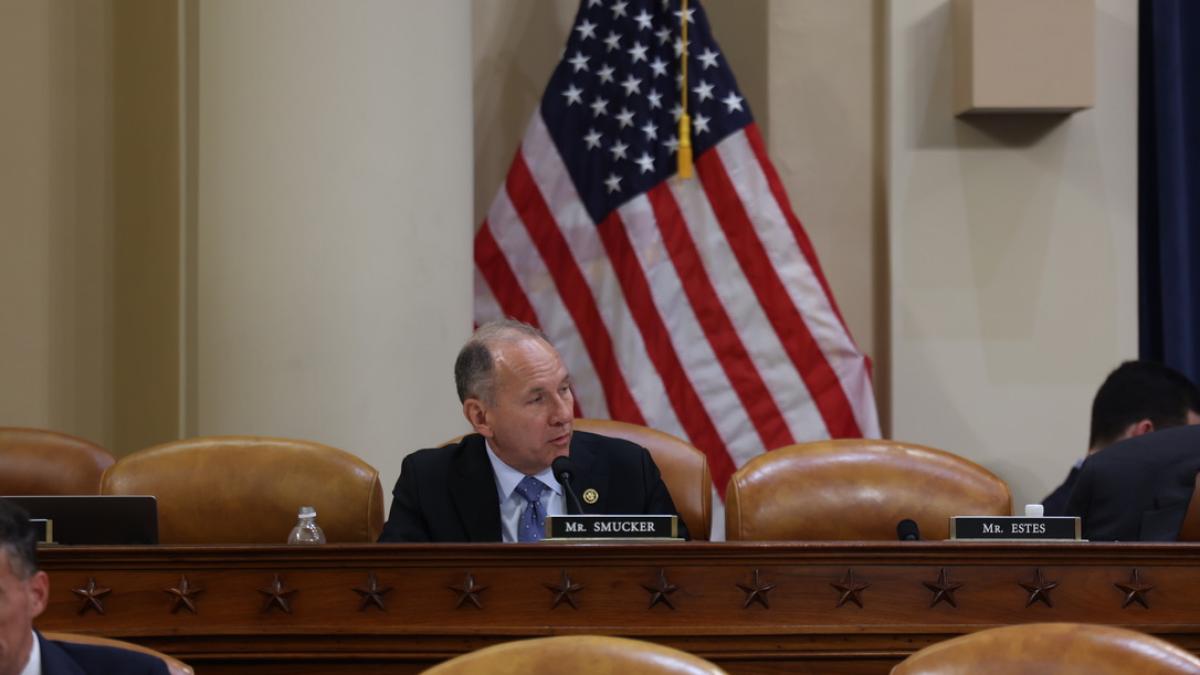

Rep. Smucker Champions Key Tax Relief Measures Included in “One Big, Beautiful Bill”

Smucker tax priorities advance as part of landmark reforms

WASHINGTON—Rep. Lloyd Smucker (PA-11), a senior member of the Committee on Ways and Means, voted to advance the committee’s legislative proposals in compliance with the instructions of H. Con. Res. 14, the Concurrent Resolution on the budget for Fiscal Year 2025.

“Today’s vote is a great step forward to enacting the “One Big, Beautiful Bill” to provide hardworking families, small businesses, seniors, and farmers with additional tax relief. This legislation will put more money back into Americans’ pockets and unleash greater business investment by providing them with much-needed certainty in our tax code. We must get this done for the American people,” said Rep. Lloyd Smucker (PA-11). “As Congress continues to move forward throughout this process, we must ensure that it is done in a fiscally responsible manner and complies with the outlines of the House’s budget resolution.”

The committee reported legislative language to permanently extend many expiring provisions of the 2017 Tax Cuts and Jobs Act, including the individual tax rates, the small business tax deduction, and relief for family-farmers from the death tax.

The Ways and Means Committee proposal contains legislative provisions authored by Rep. Smucker, including:

- Permanent Tax Relief and Certainty for Small Businesses: Permanently increasing and enhancing the small business tax deduction, known as Section 199A of the tax code. Smucker’s Main Street Tax Certainty Act has the support of 187 Members of the House and the legislation has broad support among stakeholders in PA-11 and across the nation.

- Expanded Support for Individuals with Disabilities Using ABLE Accounts: Smucker’s bipartisan ENABLE Act to allow individuals with disabilities and their families to save and invest in tax-advantaged accounts without jeopardizing their eligibility for essential federal support programs like Medicaid and Supplemental Security Income, is included making these tax provisions permanent.

- Improved Access to Primary Care: The Ways and Means Committee’s proposals include Smucker’s Primary Care Enhancement Act, which would clarify provisions of the Internal Revenue Code to remove barriers for individuals with Health Savings Accounts from using those funds to access Direct Primary Care, a health care delivery model which provides high-quality care at lower cost for individuals of all ages and incomes across America.

# # #