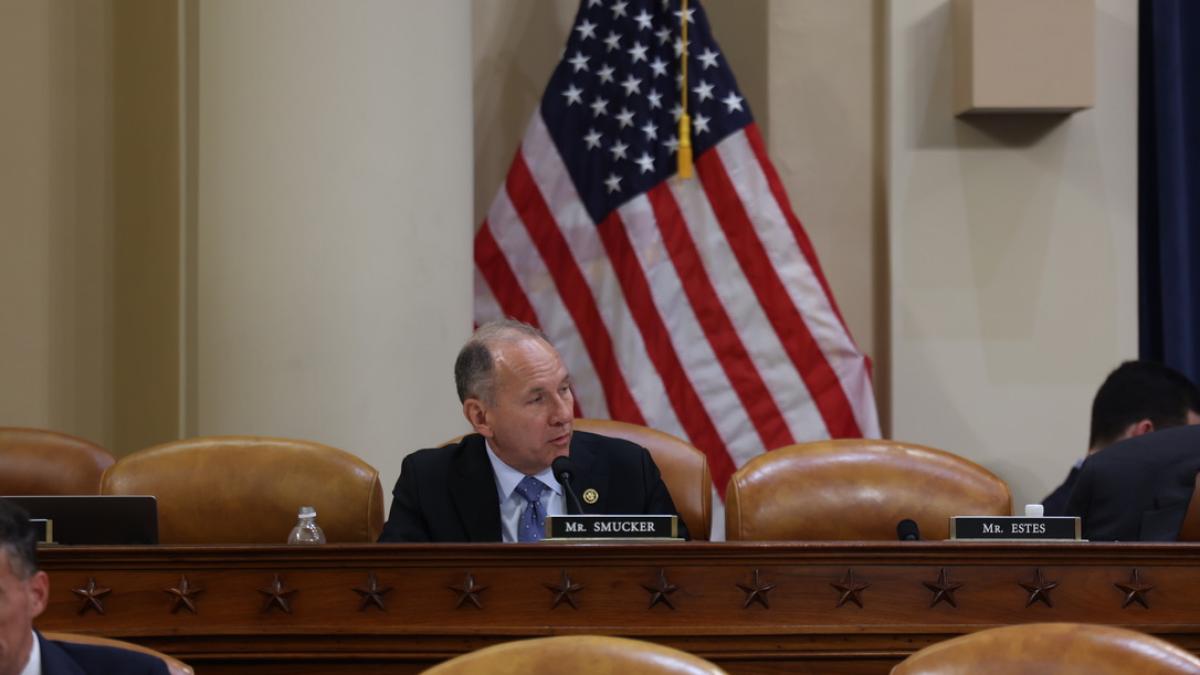

Smucker Updates Legislation to Renew and Expand Work Opportunity Tax Credit

WASHINGTON – Rep. Lloyd Smucker (PA-11) introduced an updated version of the Improve and Enhance the Work Opportunity Tax Credit (WOTC) Act to build the U.S. workforce and help connect individuals to good jobs. The bill will strengthen and extend WOTC, which has a proven track record of helping disadvantaged individuals secure employment, but is set to expire at the end of this year without congressional action.

The WOTC provides a federal tax credit to employers who invest in American workers who have consistently faced barriers to employment, including eligible veterans, SNAP recipients, individuals with disabilities, and long-term unemployed individuals. The updated legislation extends eligibility to military spouses, includes a 5-year extension of the credit, and indexes the credit to inflation.

“The best anti-poverty program is a good job. The Work Opportunity Tax Credit (WOTC) helps both employers and workers, as individuals transition back into the workforce. I remain dedicated to helping disadvantaged Americans return to work by advancing legislation that strengthens this proven tool. WOTC is a bipartisan, commonsense approach that every Member of Congress should champion,” said Representative Smucker.

Companion legislation was introduced in the U.S. Senate by Senators Bill Cassidy (R-LA), John Boozman (R-AR), Roger Marshall (R-KS), Jerry Moran (R-KS), Jim Justice (R-WV), Tim Kaine (D-VA), Maggie Hassan (D-NH), Catherine Cortez Masto (D-NV), and Peter Welch (D-VT).

“Veterans and military spouses deserve every opportunity to build stable, rewarding careers,” said Dr. Cassidy. “By reducing the burden on employers who hire them and other individuals who have fallen through the cracks, we strengthen our economy and give people the chance they need.”

WOTC has not been updated since its enactment twenty-seven years ago, and its value has been eroded significantly due to inflation. The National Employment Opportunity Network reports that the WOTC has saved the federal government an estimated $202 billion over ten years. According to EY, the legislation is estimated to directly support 350,000 new jobs, generating $3.7 billion in labor income and contributing $5.6 billion to GDP. Employers often incur higher recruitment and training costs to reach WOTC eligible populations and support their successful transition back into employment.

The Improve and Enhance the Work Opportunity Tax Credit Act would:

- Update the WOTC, which has not been changed since its enactment twenty-seven years ago, and encourage longer-service employment.

- Increase the current credit percentage from 40% to 50% of qualified wages.

- Incentivize employee retention by expanding the credit for those who work 400 or more hours.

- Eliminate the arbitrary age cap at which SNAP recipients are eligible for WOTC. This change will provide an incentive to hire older workers and better align the credit with previously adopted work reforms.

- Extend the credit for 5 years.

- Expand eligibility to military spouses.

- Index the credit to inflation.

###