Smucker, Beyer Introduce Claiming Age Clarity Act

Bipartisan Legislation Supported by BPC Action, AARP, AMAC Action

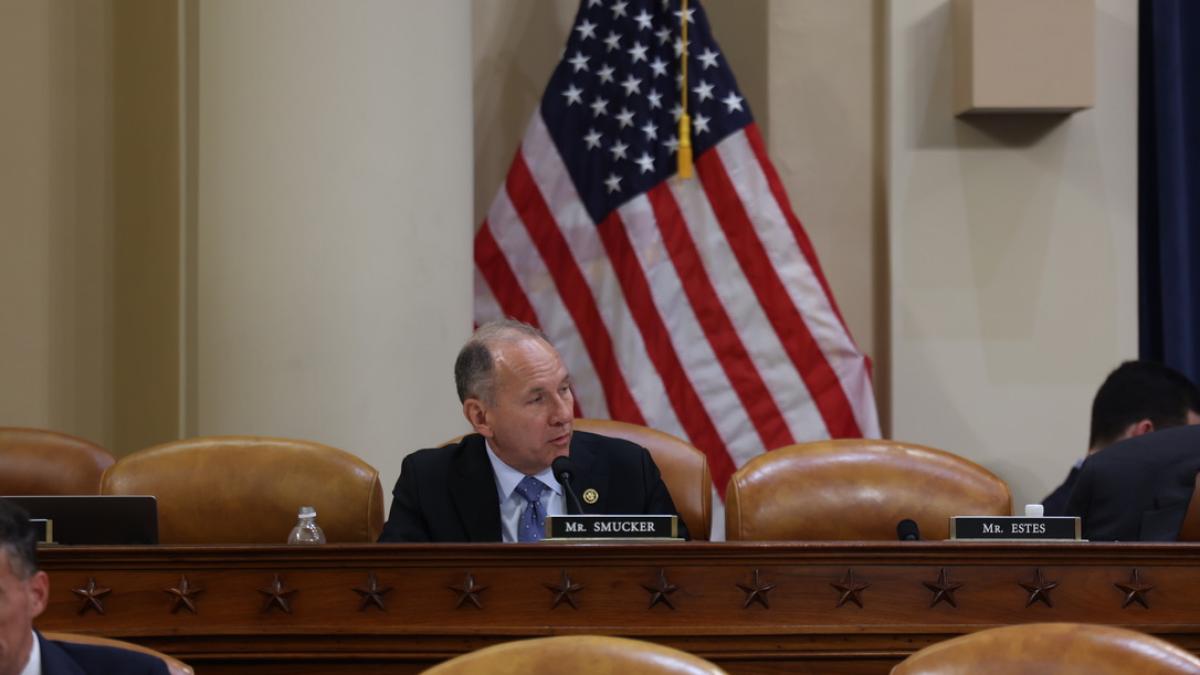

Washington—Reps. Lloyd Smucker (PA-11) and Don Beyer (VA-08), members of the House Ways and Means Committee, have introduced the Claiming Age Clarity Act to help seniors better understand how the timing of their decision to claim Social Security affects their monthly benefit.

The legislation would modernize the Social Security Administration’s terminology, so it more clearly explains how retirement age affects monthly benefits.

“Older Americans approaching retirement age should make informed decisions when deciding to claim the Social Security benefits they have earned. This straightforward legislation aims to simplify bureaucratic jargon which may mislead Americans into making poor financial decisions. I thank Rep. Beyer for joining me in introducing this legislation and will work across the aisle to advance this commonsense measure,” said Rep. Lloyd Smucker (PA-11).

“Our bill would be an important first step toward helping older Americans make clearer, more informed decisions about when to claim their retirement benefits. By better reflecting the design of Social Security’s claiming options, individuals can choose the claiming age that best fits their individual financial needs,” said Rep. Don Beyer. “With Americans living longer, ensuring they have the tools to navigate their financial future and plan effectively for retirement is more important than ever.”

Smucker and Beyer’s legislation would make the following changes to terminology used by the Social Security Administration to provide greater clarity to seniors:

- “Early Eligibility Age” would become “Minimum Benefit Age” – This is age 62, the earliest age at which someone can begin receiving retirement benefits. However, doing so comes with a permanent reduction—up to 30% less than the standard benefit.

- “Full Retirement Age” would become “Standard Benefit Age” – This is age 66-67 depending on an individual’s birth year.

- “Delayed Retirement Age” would become “Maximum Benefit Age” – This is age 70, the latest age at which someone can begin receiving retirement benefits. Doing so comes with an 8% increase in benefits per year—up to 24% more than the standard benefit.

The legislation is supported by Bipartisan Policy Center Action, AARP, and AMAC Action.

“Hard-working Americans deserve simple, straightforward information when planning for retirement, especially when it comes to claiming Social Security,” said Michele Stockwell, president of BPC Action. “This effort from Reps. Lloyd Smucker (R-PA) and Don Beyer (D-VA) does just that by updating claiming age terms to better reflect their corresponding benefits. We know that the age at which one first claims Social Security benefits drastically impacts the total income they receive over time, and this bill will ensure that retirees are better informed in their long-term planning and decisions.”

In a letter to Reps. Smucker and Beyer, AARP endorsed the legislation, writing: “AARP, which advocates for the more than 100 million Americans aged 50 and over, is pleased to endorse the Claiming Age Clarity Act, which would improve the terminology the Social Security Administration uses in relation to retirement benefit claiming ages. Your bipartisan bill will provide American workers with better and more understandable information about the impact claiming age has on their earned benefits, helping them make more informed choices about when to start collecting Social Security.”

“On behalf of AMAC Action, the advocacy affiliate of the Association of Mature American Citizens (AMAC), with over 2 million members nationwide, we thank Congressman Smucker for his commitment to America’s retirees and proudly endorse the Claiming Age Clarity Act. For too long, the terminology used by the Social Security Administration has misled millions of Americans into making suboptimal choices about when to claim their hard-earned benefits. This commonsense legislation is vital to ensuring older Americans make informed decisions that directly impact their financial security in retirement,” said Andy Mangione, Senior Vice PresidentAMAC Action

In the Senate, Sens. Bill Cassidy, Christopher Coons, Susan Collins, and Tim Kaine have introduced companion legislation.

# # #